Are you qualified to legally avoid paying up to 90% of your tax debt?

Find out within 15 minutes from our BBB A+ rated firm

Take the 59sec Tax Savings Calculator Now to Find Out:

Verified Client Results:

100% US-Based Staff

Proudly Serving Tuscon, and All of Arizona

Here's How the Process Works:

Free Initial Consultation and Financial Analysis

15 Minutes - We will go through your entire financial situation, step-by-step and see what programs you qualify for, determine how we can help, and answer any questions that you may have.

Research & Investigation

4-7 Days - Using the Power of Attorney, we will work with the IRS to determine what evidence they have against you (without disclosing anything), so we can create a plan of attack.

Fight for the Best Resolution

1-3 Months - After learning exactly what they have against you, we will negotiate with the IRS on your behalf, removing all the penalties we can, and fighting for a great settlement for you.

FREEDOM!

Forever - Once your tax burdens have been lifted, you can go on living your life again! You will finally be free of the burdens chasing you, and can start fresh with no tax debt!

Put our expert lawyers, CPAs and consultants to work for you

Highly Experienced Tuscon Tax Lawyer

The IRS loves to add to the total amount you owe, and certainly will stop at nothing to collect that money on additional penalties and interest charges.

They are the largest collection agency in the world, and we steadfastly believe that no one should have to face them by themselves.

For many people, having a government agency that is huge continuously harassing them with letters, notices and revenue officers is a dreadful idea.

That’s why our Tuscon team is here to help you. You no longer have to handle the Internal Revenue Service on your own, and certainly will have someone in your corner to help negotiate for you.

With only 15 minutes on the phone with our pros, you’ll understand precisely what you’ll qualify for, and what to do next.

Give our office a call today!

The IRS can legally steal property or your house , so prevent it before it happens and let our Tuscon team fight for you.

Bank levies are charges levied in your Tuscon bank account when you’ve outstanding tax debt. Regrettably, the process is always rough. Generally, the institution ends up freezing all the money that is available in a specified account for a period of 21 days to handle a person’s or a business’ tax obligation. During the halt, you cannot get your cash. The only possibility of getting them at this phase is when the period lapses when they’re unfrozen. Preventing the levy lets you access your funds for meeting with other expenses.

When and Why Levies Get Applied

The Internal Revenue Service bank levies are applied as a last resort for you to your account to pay taxes. It happens to people in Arizona who receive many evaluations and demands of the taxes they owe the revenue bureau. Failure leaves the IRS with no choice other than to go for your bank account. This happens through communication between the IRS and your bank. You’ll find that on a particular day in the event you are oblivious. The freezing solely changes the amount equal to your tax debt, but it can be more than that and you get a refund following the levy period. For thinking to levy along with a telling about your legal right to a hearing bank levies follow a final notice. In short, the IRS notifies you of the pending bank levies. The IRS can only take money that was on the date a levy is used in your bank when used.

How to Have Bank Levies Removed in Tuscon

There’s a window of opportunity for you to utilize to get rid from your account of bank levies. With a professional service helping out, it’ll be easy that you be aware of when to take your cash out of the bank. You can certainly do it by getting into an installment arrangement.

They could be quite complicated to execute while the solution sound simple. Have the resources to do so, you need to act quickly, comprehend every aspect of the law and deal with associated bureaucracies imposed by banks and also the IRS. The smart move would be to call us for professional help with your IRS situation. We have expertise and abilities which have made us a number one pick for several folks. For partnered tax professional aid, contact us for more details and help.

If you have had a tax lien put on your home or property, you must act quick to avert future levies

What is a tax lien?

The lien cushions the claim of the authority to all your existing property, inclusive of personal, financial and real estate assets. Generally, a federal tax lien is levied whenever the IRS analyses your liabilities, when they deliver to you a bill that lays out into detail how much you’re owed and additionally when you decline to pay your debts on schedule. When a lien is submitted, it transforms it into a public record matter. Liens normally record the exact figure owed to IRS in the precise time that it is levied in a public file known as the Notice of Federal Tax Lien. The file notifies lenders that the government has a right to confiscate your property at any particular time. This particular information is conventionally acquired by credit reporting agencies that are different so tax liens ultimately reflect on your credit reports.

Federal tax liens can readily be prevented from being lodged by paying all your tax dues up before the IRS decide to levy a lien in your assets, and also. Through establishing installment deals which sufficiently fulfill the demands of the IRS as not to file a lien, they can also be evaded. A federal tax lien can’t be filed if a taxpayer chose to prepare a streamlined or guaranteed payment treaty. Such deals require the citizen maintain a balance of $10,000 or a figure less than that for the bonded installment treaty and for the streamlined arrangement , it should be $25,000 or less. In a situation where the taxpayer owes more than $25, 000, a tax lien can be averted if he or she tries their best to reduce that particular outstanding balance to exactly $25,000 or less and alternatively lays out a streamlined treaty. There are just two methods of removing tax liens: release and withdrawal.

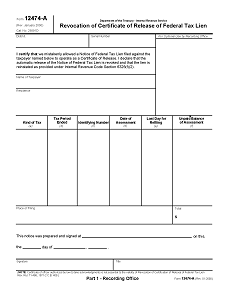

How can I have my tax lien wiped away?

Withdrawing federal tax liens is like it never existed when the IRS resort to revoking the lien. Lien withdrawals typically take place the lien is filled. In a case where the tax lien is mistakenly filed, contact the IRS as soon as possible. The IRS representatives will check your account to be able to substantiate you have no tax arrears then take the essential steps in withdrawing the lien.

Releasing a national or Arizona state tax lien normally means that the imposed lien constrains your assets. Promptly after lien releasing, the county records will instantly be brought up to date to demonstrate that’s has been released. Nonetheless,the existence of a federal tax lien once will be exhibited in your credit reports for ten years. Liens are often released within a month of clearing the outstanding tax arrears or upon establishing the agreements that were streamlined and bonded.

What to Do Next

To sort intricate lien dilemmas encountered, for example discharge,withdrawal,subrogation and subordination (Collection advisory group), Resolving fundamental lien problems, requesting or confirming a lien, releasing a lien (Centralized Lien operation), Guidance from organizations within IRS (Taxpayer Advocate service), Inquiring whether bankruptcy determined your tax arrears (Centralized insolvency operation),do not wait to go to our offices to assist you in effectively removing your tax liens by settling your debts on schedule to avert the authorities from seizing your property or instead you can give us a call and our Tuscon representatives shall have the ability to help you navigate through any impending federal tax liens.

In case you have had a garnishment placed on your own wages, our Arizona team can have it removed fast.

What is a Garnishment?

If you owe the Internal Revenue Service back taxes and do not react to payment notices or their phone calls chances are that you may be subjected to an IRS wage garnishment. In other quarters, it’s also called a wage levy or wage attachment.

The garnishment process is usually fairly drawn-out, first the IRS discovers how much you really owe them in back taxes, once this has been done, they will send you several payment request notices in the email as well as more than a single phone call with relation to the debt in question. Failure to react to the phone calls and notices,automatically results in a ‘Notice of Intent to impose” being sent to your last known mailing address. You normally have thirty (30) days to get in touch with IRS with regards to this notice before they go ahead and forwarding the notice to your Tuscon employer. Once this notice was sent to the Tuscon employer, you have a further fourteen (14) days to make a response before garnishment of wages starts. The company usually has at least one pay period after receiving a notice of levy before they may be expected to send the funds.

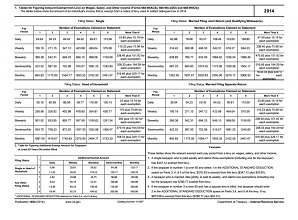

How Much Can the IRS Take from My Paychecks?

IRS garnishment rules commonly allow the Internal Revenue Service to deduct or garnish more or 70% of an employee’s wages; this is largely done with the intention of convincing his representative or the worker to get in touch with IRS to settle the debt.

Wage garnishments are normally one of the most competitive and harsh tax collection mechanics and one should never take them lightly, as a matter of fact, they would rather solve tax issues otherwise and just sanction this levy when they believe they have ran out of workable options. This is typically not possible because of wide selection of reasons even though paying off the taxes you owe the IRS is the easiest way out of such as scenario. First and foremost, you may not possess the whole sum or the tax liability may belong to your ex spouse or someone else, you will be asked to establish this though.

What should I do next because of a garnishment?

You therefore have to discuss any payment arrangements with the Internal Revenue Service and do so fairly quick. In this regard, it’s imperative that you simply get in touch with an expert who will help you quit or end the garnishment and to readily obtain a wage garnishment release. We’re a Tuscon BBB A+ rated tax business with a team of tax attorneys that are exceptionally qualified with a long list of satisfied customers along with years of experience to prove this. Touch base with us and we guarantee to get back to you within the shortest time possible, usually within one working day or less.

Do not get conned by a tax aid business with no track record - call our BBB A rated business now.

Many people are law-abiding Tuscon citizens and they fear the dangers of IRS action. These businesses commit even and consumer fraud larceny and tempt innocent individuals in their scams! There are many ways in which they fool people of their hard earned money: by charging upfront non-refundable payments without supplying any guarantees, by misrepresenting future results, by posing as a service provider and selling the sensitive information of the consumers to other service providers, by outright larceny from customers and so on. Therefore, you must exercise care when you’re attempting to find a tax resolution business for yourself.

What Scammy Companies can do

Not all Arizona tax relief businesses who promise to negotiate with the IRS for you are trustworthy. Therefore, averting IRS tax help scams is very significant because there are all those deceptive businesses out there. It is possible to prevent being taken advantage of, all you need to do to follow a number of hints that are useful and would be to prepare yourself in this regard! First things first, never pay in full upfront, irrespective of whether the tax resolution firm blatantly asks for it in an obscure manner at some point of time or in the beginning. An authentic tax resolution firm will consistently folow a mutually acceptable financial arrangement wherein the payments may be made on a weekly, bi-weekly monthly or basis.

Second, it is advisable to be quite careful when you’re selecting a specific tax resolution firm to work with. Chances are the company is deceitful if they promise you the desired effects or state that you just qualify for any IRS program without going through a complete fiscal analysis of your current situation then. After all, it is not possible for businesses to pass such judgment without going through your complete financial evaluation first. So, don’t fall for their sugar coated promises and search for other authentic businesses instead.

How to find out about the company

The internet is a storehouse of information, but you should be careful about using such advice. For handling your tax related issues don’t just hire any random firm with great ads or promotional efforts. To be able to select the right firm, it is best to research about the same in the Better Business Bureau website and see their ratings or reviews. Consequently, doing your assignments and investing time in research is definitely a shrewd move here.

A site with an excellent rating on BBB is definitely one which you can place your trust in. We’re a BBB A+ rated Tuscon business, we help individuals by relieving their IRS back tax debts. Our tax solutions are reasonable, in order to make sure that all your tax debts are eliminated, we don’t merely negotiate with the Internal Revenue Service on your behalf, but rather develop a practical strategy first. We do all the hard work for you while you concentrate on other important facets of your own life. Due to our vast experience and expertise in the field, you may rest assured your tax problems would be resolved quickly and efficiently when you turn for help to us.

Let our attorneys deal with the Internal Revenue Service and state of Arizona, so you can concentrate on running your business.

The Internal Revenue Service is a formidable collection machine for the authorities, and in case your Tuscon company has dropped into IRS or Arizona company tax debt, they will collect. So, if your business has delinquent taxes including payroll tax debts there isn’t any need to scurry for cover (and remember – never conceal) even in the event you know little or nothing about coping with IRS business tax debts. There are seasoned professionals prepared to help.

Un-Paid PayRoll Tax Returns

The Internal Revenue Service looks at payroll tax – taxes imposed on employers and workers – from two viewpoints:

- (a) Taxes an employer pays the IRS predicated on the wages paid to the employee (known as withholding tax’ and is paid out of the companies own funds) and

- (b) A portion of wages the company deducts from an employee’s wages and pays it to the IRS.

Repayment Timeline

The program of these payments depends on the average sum being deposited (based on the look back period’ – a twelve month period ending June 30). This payment program can be monthly or semi-weekly.

If you are a company that is new and didn’t have some workers during your look back period’ or if your entire tax liability is up to USD 50,000 for your look back period’, you must follow a monthly program.

In case your payroll tax liability is less than USD 50,000 you’ll have to follow a semiweekly deposit schedule. These taxes should be deposited by Sunday, Monday, Tuesday or Wednesday following the Friday payday. You’ll fall into a payroll tax debt in the event that you fail to pay your taxes on these days. You should seek the professional services of tax professionals to direct you through this labyrinth of procedures and keep from falling into payroll tax debt and prevent substantial fees.

How To Deal With Unfiled Tax Debts

Revenue collected through taxes including payroll tax are spent on financing programs like; healthcare, social security, unemployment compensation, worker’s compensation and at times to improve local transportation that takes many workers to and from work.

When you have to take care of IRS tax debts, it’s utmost important to keep in touch with your IRS officials – never avoid or conceal from them. Most IRS fees include a compounded rate of interest of 14% this can turn a business turtle in an exceedingly short time dealing with IRS company tax debt it predominant.

How a Professional Tuscon Tax Pro Can Assist You

Being in an IRS business debt situation is serious. You might have time on your own side when they gain momentum things get worse for you, although since the IRS is slow to start processing your account. However, you aren’t helpless. There are processes you may be qualified for that a Arizona professional can use his good offices with the Internal Revenue Service to assist you over come your business debts.

For those who never have heard of an Offer in Compromise, Tax Lien Interval, Uncollectible Status and Insolvency, amongst others, you are in need of a Tuscon professional’s help. Waste no more time, touch base with us now to get out of business tax debt and save your business from close.

Other Cities Around Tuscon We Serve

| Address | Tuscon Instant Tax Attorney1 S Church Ave, Tuscon, AZ 85701 |

|---|---|

| Phone | (702) 919-6003 |

| Customer Rating | |

| Services / Problems Solved | Removing Wage GarnishmentsGetting Rid of Tax LiensRemoving Bank LeviesFiling Back Tax ReturnsStopping IRS LettersStopping Revenue OfficersSolving IRS Back Tax ProblemsIroning out Payroll Tax IssuesRelief from Past Tax IssuesNegotiating Offer in Compromise AgreementsNegotiating Innocent Spouse Relief ArrangementsPenalty Abatement NegotiationsAssessing Currently Not Collectible ClaimsReal Estate PlanningLegal Advice |

| Tax Lawyers on Staff | Steve Sherer, JD Kelly Gibson, JD Joseph Gibson, JD Lance Brown, JD |

| Cities Around Tuscon We Serve | Amado, Arivaca, Benson, Catalina, Cortaro, Elgin, Green Valley, Mammoth, Marana, Mount Lemmon, Oracle, Patagonia, Picacho, Pomerene, Red Rock, Rillito, Sahuarita, Saint David, San Manuel, Sonoita, Tubac, Tucson, Tumacacori, Vail |