Chandler residents may qualify to save up to 90% on their tax debt bill

Find out if you are one of them, by calling our BBB A+ rated firm today

Take the 59sec Tax Savings Calculator Now to Find Out:

Verified Client Results:

100% US-Based Staff

Proudly Serving Chandler, and All of Arizona

Here's How the Process Works:

Free Initial Consultation and Financial Analysis

15 Minutes - We will go through your entire financial situation, step-by-step and see what programs you qualify for, determine how we can help, and answer any questions that you may have.

Research & Investigation

4-7 Days - Using the Power of Attorney, we will work with the IRS to determine what evidence they have against you (without disclosing anything), so we can create a plan of attack.

Fight for the Best Resolution

1-3 Months - After learning exactly what they have against you, we will negotiate with the IRS on your behalf, removing all the penalties we can, and fighting for a great settlement for you.

FREEDOM!

Forever - Once your tax burdens have been lifted, you can go on living your life again! You will finally be free of the burdens chasing you, and can start fresh with no tax debt!

Experienced lawyers, CPAs and professionals are ready to help you today

Highly Experienced Chandler Tax Lawyer

Among the worst things you can do with IRS back tax debt is continue to fail it for years at a time. The Internal Revenue Service likes to add on interest costs and additional fees to the quantity you owe, and will stop at nothing to collect that money.

They’re the greatest collection agency in the world, and we steadfastly believe that no one should have to face them by themselves again.

For most of US, having a huge government agency constantly harassing them with revenue officers and letters, notices is a terrible idea.

That is why our Chandler team is here to help you. You certainly will have someone in your corner to help negotiate for you, and no longer need to face the Internal Revenue Service on your own.

So if you owe the federal government, or the state of Arizona, our dedicated law firm is here to make your own life simpler.

With only 15 minutes on the telephone with our specialists, you’ll learn exactly what you may qualify for, and what to do next.

Give our office a call today!

In case you have had a bank levy put on accounts or your property, let our Arizona team remove it for you within 48 hours.

Bank levies are charges imposed on your own Chandler bank account when you’ve outstanding tax debt. Unfortunately, the procedure is not consistently smooth. Usually, the institution ends up freezing all the money that is available in a specified account for a period of 21 days to deal with a man’s or a company’ tax obligation. During the halt, you cannot get your money. The sole possibility of getting them at this phase is when the interval lapses when they’re unfrozen. Preventing the levy allows you to access your funds for matching with other expenses.

Why and When Levies Get Slapped On

The Internal Revenue Service bank levies are applied to your account as a last resort for you to pay taxes. It happens to people in Arizona who receive demands and many appraisals of the taxes they owe the revenue bureau. Failure to act within the legal duration of a tax obligation leaves the IRS with no choice besides to go for your bank account. This happens through communication between the IRS and your bank. You will find that on a certain day, in case you are unaware. It can be more than that and you get a refund after the levy period, although the sum equivalent only influences to your tax debt. For meaning to levy plus a telling about your legal right to a hearing, a final notice is followed by bank levies. In summary, the IRS notifies you of the bank levies that are pending. When applied, the IRS can only take cash which was on the date a levy is implemented in your bank.

How to Get Your Levies Removed in Chandler

There is a window of opportunity for you to use to eliminate bank levies from your account. Getting professional help as you take measures to safeguard your bank assets is a sensible move that you just should take. With a professional service helping out, it will not be difficult for you to understand when to take your cash out of the bank. You also have to enter into a payment arrangement with all the Internal Revenue Service to stop future bank levies, before the bank levy happens besides removing your funds. You can do it by getting into an installment arrangement. You can also appeal and seek qualification for ‘uncollectable status’.

They can be quite complex to carry out while the solution sound easy. Have the resources to do so, you must act quickly, comprehend every aspect of the law and deal with associated bureaucracies imposed by banks and also the IRS. The smart move would be to phone us for professional help with your IRS scenario. We’ve experience and abilities that have made us a number one choice for lots of people. For partnered tax professional aid, contact us for additional information and help.

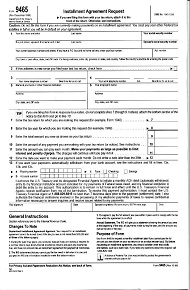

So you don't have to pay all at once, an Installment Agreement can spread your payments out over time

This arrangement allows for monthly payments to be made. As long as the taxpayer pays their tax debt in full under this particular Arrangement, they are able to reduce or get rid of the payment of interest and penalties and avoid the payment of the fee that’s associated with creating the Understanding. Establishing an IRS Installment Agreement requires that all necessary tax returns have been filed prior to applying for the Agreement. The citizen cannot have any unreported income. If more than $50,00 in tax debts are owed, then the citizen may apply for a longer period to pay the debt.

Benefits of an Installment Plan

The agreement will bring about some important benefits for the taxpayer. While an agreement is in effect, enforced collection activity WOn’t be taken. Life will be free of IRS letters and notices. There is going to be more fiscal independence when the taxpayer can count on paying a set payment every month rather than having to be concerned about putting lump sum amounts on the tax debt. The citizen will eliminate interest and ongoing IRS fees. The Internal Revenue Service will help the citizen keep the arrangement in force in the event the taxpayer defaults on a payment supplying the IRS is notified promptly.

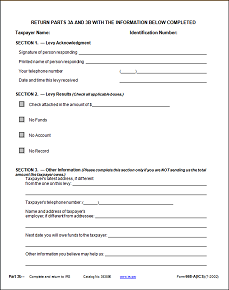

Obligations of the Installment Agreement Compromise

Some duties have the Installment Agreement. When due, the minimum monthly payment should be made. The income of an individual taxpayer or the incomes of citizens that were joint must be disclosed when putting in an application for an Installment Agreement. Sometimes, a financial statement should be supplied. All future returns have to be submitted when due and all of the taxes should be paid when due. This method of making monthly payments enable the taxpayer to request the lien notice be withdrawn. However, the lien may be reinstated if the taxpayer defaults on the Installment Agreement.

The citizen can negotiate an Installment Agreement with the IRS. However, particular information should be provided and any information could be subject to affirmation. For citizens a financial statement will be required.

How to Prepare to Apply for an Agreement

While citizens can apply for an IRS Installment Agreement, there are several precautions that should be contemplated. Although the IRS attempts to make applying for an Installment Agreement a procedure that is relatively easy, there are some circumstance which can make this a challenging task. Since many problems can be eliminated by an Installment Agreement with the Internal Revenue Service, it is necessary to get it right the very first time the application is made.

We are the BBB A+ rated law firm serving all of Chandler and Arizona, that could provide skilled help to you. Our many years of experience working with the Internal Revenue Service on behalf of Chandler citizens that have problems qualifies us to ensure acceptance of your application for an Installment Agreement.

Un Filed tax returns can add up to mean thousands in extra penalties and interest costs as time passes, so act now to avoid paying more.

Have you ever forgotten to file your unpaid tax returns for a number of years? We can help.

Have you ever forgotten to file your unpaid tax returns for a number of years? We can help.

The W-2S and 1099 forms for every tax year are required when filing your tax returns that are back, you receive. In the event you’re eligible to deductions and credits; you will have to collect any other supporting document which will demonstrate your eligibility to the claim.

You must use the form to request for 1099S, W-2S which should provide support for your tax write-offs. IRS will provide you with a transcript including the information you have to file your tax returns. The IRS may take up to 45 days to process this request.

In addition, your tax returns that are back should be filed by you on the original forms for that tax year. Begin by searching for them in the IRS site. Double check to ensure that you’re employing the instructions related to exactly the same tax year returns are filling for after you have gathered all the applicable files. Tax laws are constantly changing and using the wrong directions may require you to begin the filing procedure once more. Eventually, they must submit all of the forms to the Internal Revenue Service through the address.

What to Do With Un-Paid Returns

As possible, in case you have some additional income tax for the preceding years, you need to contain as much payment. This fashion in which you’ll reduce interest costs accumulation. Unlike the tax fees which halt once they’re at the maximum to collect, the monthly interests continue to pile up until the tax has been paid by you. They will send you a notice of the exact amount you should pay as a penalty and interest rate after the IRS has received your tax returns.

You’ll need to work with all the Internal Revenue Service if you’re not able to pay your tax returns in full. Nevertheless, you should note the past due debts and back taxes, can decrease your federal tax refund. Treasury offset application may use any state or federal debt that is unpaid to settle.

You should know the Department of Treasury’s of the Fiscal Service, the Bureau of the Fiscal service or only BFS – runs the program that is counterbalance from the treasury. It might use your total tax refund or component to pay some debts including delinquent student loans, parent support, and unemployment compensation debts. You might have the right to component or the whole offset, in the event you have filed tax returns together with your partner.

The law prohibits IRS from using levies/liens in collecting individual responsibility payments that are common. But in case you owe any common duty payment, IRS can offset the liability against tax refund due to you.

What You Should Do If You Have Neglected to File

You can consult with our BBB A+ rated Chandler tax law business for help for those who haven’t filed your back tax returns for many years.|} Our crew of specialists in Arizona is always ready to help you solve your problems and in addition they’re constantly ready to answer your questions.

Let our Chandler team allow you to remove a wage garnishment fast, and get back your hard earned money.

What is a Garnish of Wages?

If you owe the Internal Revenue Service back taxes and don’t respond to payment notices or their phone calls then chances are that you may be subjected to an IRS wage garnishment. In other quarters, it is also known as wage attachment or a wage levy. It is worth noting that a court order is generally not required and other federal and state laws pertaining to the total amount of exempted from garnishment does provide several exceptions for the wage levies.

The garnishment procedure is generally fairly lengthy, first the IRS discovers how much you really owe them in back taxes, after this has been done, they will send you several payment request notices in the mail in addition to more than one phone call with relation to the debt in question. Failure to respond to the phone calls and notices,automatically leads to a ‘Notice of Intention to levy” being sent to your last known mailing address. You usually have thirty (30) days to touch base with IRS with regards to this notice before they go ahead and forwarding the notice to your Chandler company. After this notice was sent to the Chandler employer, you’ve got a further fourteen (14) days to make a reply before garnishment of wages begins. The company generally has at least one pay period before they are expected to send the funds after receiving a notice of levy.

How Much Can they Take from My Paychecks?

IRS garnishment rules commonly permit the IRS garnish or to deduct 70% or more of an employee’s wages; this is mostly done with the intention of convincing his representative or the employee to get in touch with IRS to settle the debt.

Wage garnishments are generally one of the most competitive and harsh tax collection mechanisms and one should never take them lightly, as a matter of fact, they’d rather work out tax problems otherwise and just sanction this levy when they feel they have ran out of workable alternatives. Even though paying off the taxes you owe the IRS is the simplest way out of such as situation, this is generally not possible due to a wide array of reasons. First of all, you may not have the entire sum or the tax liability may belong to your ex spouse or somebody else, you will be required to demonstrate this though.

What should I do about wage garnishment?

Do so quite fast and you therefore have to discuss any payment arrangements with the Inland Revenue Service. In this regard, it’s imperative that you just touch base with an expert who will enable you to easily obtain a wage garnishment discharge and cease or end the garnishment. We are a Chandler BBB A+ rated tax business with a team of exceptionally competent tax lawyers with years of expertise as well as a long list of satisfied customers to demonstrate this. Get in touch with us and we promise to get back to you within the shortest time possible, usually within one working day or less.

A 15 minute consultation with our Chandler team can help possibly save you tons of dollars

What is it

The IRS helps the customer faced with serious tax issues bailing them out up to less compared to the sum owed or rather by paying. Nonetheless, not all taxpayers that are distressed qualify for IRS Offer in Compromise Agreement. This is completely after assessment of the client has been carried out, because qualification relies on several variables. The IRS Offer in Compromise Deal has an instrumental role in aiding taxpayers with fiscal challenges that are distressed solve their tax problems. This means the IRS acts as the intermediary which helps the citizen pay their tax debt in the most convenient and adaptable mode.

What Does it Take to Qualify?

Filling the applications doesn’t ensure the Chandler taxpayer a qualification that is direct. The IRS starts evaluation procedure and the total assessment that could leave you incapable of settling your taxes. These applications are then supported with other applicable documents which is utilized by the Internal Revenue Service to determine the qualification of the citizen for an Offer in Compromise Agreement. Nonetheless, there are some of the few qualifications process that has to be fulfilled totally be the taxpayer. All these are the three fundamental tenets of qualification that every citizen seeking help from IRS must meet to be able to be considered.

What to do now

This is an amazing law firm that’ll serve as a yard stick for individuals who demand proper help in negotiating for an IRS offer in compromise arrangement. Don’t hesitate to contact them because they’ve a good safety reputation and a powerful portfolio. They have a team of competent and dynamic professionals that are always on hand to assist you. Try them today and experience help like never before. It is simply the best when it comes to discussion of an IRS offer in compromise deal.

Other Cities Around Chandler We Serve

| Address | Chandler Instant Tax Attorney555 W Chandler Blvd, Chandler, AZ 85225 |

|---|---|

| Phone | (702) 919-6003 |

| Customer Rating | |

| Services / Problems Solved | Removing Wage GarnishmentsGetting Rid of Tax LiensRemoving Bank LeviesFiling Back Tax ReturnsStopping IRS LettersStopping Revenue OfficersSolving IRS Back Tax ProblemsIroning out Payroll Tax IssuesRelief from Past Tax IssuesNegotiating Offer in Compromise AgreementsNegotiating Innocent Spouse Relief ArrangementsPenalty Abatement NegotiationsAssessing Currently Not Collectible ClaimsReal Estate PlanningLegal Advice |

| Tax Lawyers on Staff | Steve Sherer, JD Kelly Gibson, JD Joseph Gibson, JD Lance Brown, JD |

| Cities Around Chandler We Serve | Apache Junction, Arizona City, Avondale, Bapchule, Carefree, Casa Grande, Cashion, Cave Creek, Chandler, Chandler Heights, Coolidge, El Mirage, Eloy, Florence, Fort Mcdowell, Fountain Hills, Gilbert, Glendale, Goodyear, Higley, Laveen, Litchfield Park, Luke Afb, Maricopa, Mesa, New River, Paradise Valley, Peoria, Phoenix, Picacho, Queen Creek, Rio Verde, Sacaton, Scottsdale, Stanfield, Sun City, Sun City West, Superior, Surprise, Tempe, Tolleson, Tonto Basin, Tortilla Flat, Valley Farms, Waddell, Youngtown |