Phoenix residents could potentially qualify to legally avoid paying up to 90% of the tax debt

Find out if you do from our BBB A+ Rated Tax Experts

Take the 59sec Tax Savings Calculator Now to Find Out:

Verified Client Results:

100% US-Based Staff

Proudly Serving Phoenix, and All of Arizona

Here's How the Process Works:

Free Initial Consultation and Financial Analysis

15 Minutes - We will go through your entire financial situation, step-by-step and see what programs you qualify for, determine how we can help, and answer any questions that you may have.

Research & Investigation

4-7 Days - Using the Power of Attorney, we will work with the IRS to determine what evidence they have against you (without disclosing anything), so we can create a plan of attack.

Fight for the Best Resolution

1-3 Months - After learning exactly what they have against you, we will negotiate with the IRS on your behalf, removing all the penalties we can, and fighting for a great settlement for you.

FREEDOM!

Forever - Once your tax burdens have been lifted, you can go on living your life again! You will finally be free of the burdens chasing you, and can start fresh with no tax debt!

Our firm of experts can help you get the relief you need today

Highly Experienced Phoenix Tax Lawyer

One of many main problems that most Phoenix citizens run into in relation to IRS back taxes is feeling overwhelmed and anxious about the money that they owe. With the IRS sending threatening letters and notices, revenue officers, and even taking away assets, cash and property, it might be an extremely chilling encounter.

We believe that no one should have to go up against the IRS anymore.

It is simply not fair what they get ordinary tax payers through, and we believe they shouldn’t get away with it.

That means you do not pay a penny for the complete use of our experienced team for a full week.

30 Day Money Back Guarantee that is on the very top of our no questions asked.

So what are you waiting for? The longer that you wait and put it away, the more fees and interest charges the IRS will tack on to the quantity that you owe. Take actions and call our Phoenix team a call now to get started!

Give our office a call today!

Stop letting interest fees and penalties eat up all of your money, and let our Arizona fee abatement system help.

Once the IRS hit you or your business with a tax bill, it generally appends interest charges and fees. These additional fees can be dreadful such that an old tax bill could have double in interest and penalties immobilized onto it. Some penalties, like late payments, they are included by IRS computers. IRS staff may inflict punishments like filing a late return, if you dishonored a tax code provision.

The Internal Revenue Service assumes you recognize them, if you do not whine once penalties are imposed. Luckily, a penalty can be confiscated by the IRS just as simple as it contained one. The key to the realm of the tax penalty relief is revealing a practical reason behind your letdown to mind with tax law.

The amount of distinct tax code fines is staggering. Here are some of the penalties that IRS will tack on to the debts of individuals who’ve not filed their back tax debts.

Incorrectness:

The IRS will impose a 20 % penalty on you if you significantly minimized your taxes or were negligent. This precision-associated fine is applied when you CAn’t establish a tax write-off in a review, or you did not submit all your income and it is learnt by the IRS.

Civil deceit:

A fee 75% can be attached, in case the IRS finds that you weren’t reported your income with a deceptive intent.

Delayed Payment:

Typically, the IRS will add a fee from 0.25 % to 1% for each month to an income tax bill, which isn’t paid punctually. This late payment fine is when you make a delayed payment, or tacked on by the Internal Revenue Service computer automatically whenever you file a tax return devoid of paying the outstanding balance. Fines for failing to make payroll tax deposits are substantially elevated.

Not Filing on time:

The IRS can fine you an additional 5% per month on any outstanding balance if you did not file your return on time. However, this punishment can be applied just for the first five months following the due date of the return, equal to a 25% higher price. The IRS can still impose lesser penalties if there’s no outstanding balance.

Once you know the reason and the way the IRS strike fines against you, you can demand that they eliminated or be abridged. The IRS name for this process is called an abatement. About one third of all tax fees are ultimately abated, and even it’ll not be less should you understand the methods to contest them.

Merely telling the IRS that you do not like a penalty, or cannot actually afford to compensate it, WOn’t work. You need to demonstrate reasonable cause, which means a plea that is good. As stated by the IRS, any sound cause advanced by a citizen as the reason for postponement in filing a return, making deposits, when owed will be carefully analyzed, or paying tax.

Approaches to request for interest abatement and an IRS penalty

Enclose the following documents with your written request.

- Letter from a registered medical practitioner, describing your condition that prevented you from filing your tax return punctually.

- Death certificate substantiating the bereavement of close relations or your blood.

- A comprehensive report from the fire department if your property is damaged due to fire.

What to Do Now

There are a few simple and productive ways to get your tax fines or interest condensed or even eliminated entirely, for those who have been levied fees by the IRS. We have really been in the industry for years and we’re devoted to offer our customers a professional IRS fee and interest abatement service officially. Contact us today to resolve your tax problems all and the associated fees imposed by the IRS on you or in your Phoenix company.

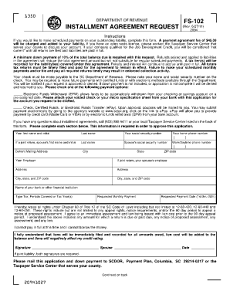

An Installment Agreement can spread out your payments over time, which means you don't have to pay

This agreement allows for monthly payments to be made. So long as their tax debt is paid by the taxpayer in full under this particular Agreement, they are able to reduce or eliminate the payment of fees and interest and prevent the payment of the fee that’s connected with creating the Agreement. Establishing an IRS Installment Agreement requires that all necessary tax returns are filed prior to applying for the Understanding. The taxpayer cannot have any unreported income. In some cases, a citizen may request a longer interval than 72 months to pay a tax debt of $50,000 or less. back

Benefits of an Payment Plan

The agreement will result in certain important benefits for the citizen. Enforced collection activity will not be taken while an arrangement is in effect. Life will be free of IRS letters and notices. There’ll be more fiscal independence when the citizen can count on paying a set payment each month rather than having to be worried about putting lump sum amounts on the tax debt. The taxpayer will remove interest and ongoing IRS penalties. The IRS will help in the event the taxpayer defaults on a payment supplying the IRS is notified instantly, the taxpayer keep the arrangement in force.

Problems with the Installment Agreement

Some obligations include the Installment Agreement. The minimum payment should be made when due. The income of the incomes of combined citizens or an individual taxpayer must be disclosed when putting in an application for an Installment Agreement. Sometimes, a financial statement should be provided. All future returns must be filed when due and all the taxes owed with these returns should be paid when due. This method of making monthly payments enable the taxpayer to request the lien notice be withdrawn. In the event the taxpayer defaults on the Installment Agreement, however, the lien could be reinstated.

The taxpayer and the Internal Revenue Service can negotiate an Installment Agreement. However, particular information should be provided and any info may be subject to affirmation. For citizens a financial statement will be required.

How to Prepare to Apply for an Agreement

There are several precautions that must be contemplated while citizens can apply for an IRS Installment Agreement. Even though the IRS tries to make applying for an Installment Agreement a relatively easy procedure, there are some situation which can make this a challenging job. Since many issues can be eliminated by an Installment Agreement with the Internal Revenue Service, it is essential to get it right the first time the application is made.

We are the BBB A+ rated law firm serving all of Phoenix and Arizona, that can offer you expert help. Our many years of experience working on behalf of citizens who have problems paying their tax debt with the IRS qualifies us to ensure approval of your application for an Installment Agreement.

If your Phoenix business has run into payroll or tax issues with the authorities, we can help.

The IRS is a formidable collection machine for the government, and they’re going to collect, if your company has dropped into IRS or Arizona business tax debt. So, if your business has overdue taxes including payroll tax debts there isn’t any need to scurry for cover (and remember – never hide) even in the event you know little or nothing about dealing with IRS business tax debts. There are experienced professionals prepared to assist.

Un-Paid PayRoll Taxes

The IRS looks at payroll tax – taxes imposed on employees and employers – from two standpoints:

- (a) Taxes a company pays the IRS predicated on the wages paid to the employee (known as withholding tax’ and is paid out of the companies own funds) and

- (b) A percentage of wages the employer deducts from an employee’s wages and pays it to the IRS.

The employer ends up footing the bill for both the types of taxes as the withholding tax results in lower wages.

Repayment Schedule

This payment program may be monthly or semi weekly.

In case you are a company that is new and didn’t have any workers during your look back span’ or if your overall tax liability is up to USD 50,000 for your look back interval’, you must follow a monthly schedule.

In case your payroll tax liability is less than USD 50,000 you will have to follow a semi-weekly deposit schedule. You may fall into a payroll tax debt, in the event that you don’t pay your taxes on these days. You should seek the professional services of tax professionals keep from falling into payroll tax debt and to direct you through this labyrinth of processes and give a wide berth to significant penalties.

How To Deal With Unpaid Tax Debt

Revenue collected through taxes including payroll tax are spent on capital plans for example; healthcare, social security, worker’s compensation, unemployment compensation and at times to enhance local transfer that carries many workers to and from work.

When you need to take care of IRS tax debts, it is utmost important to stay in contact with your IRS officials – never avoid or conceal from them. Most IRS fees comprise a compounded rate of interest of 14% this can turn a business turtle in a very short time, so dealing with IRS business tax debt it overriding.

How a Professional Phoenix Tax Expert Can Assist You

Being in an IRS company debt situation is serious. You might have time on your side when they gain impetus things get worse for you, although because the IRS is slow to begin processing your account. Yet, you aren’t helpless. There are procedures you might be qualified for that a Arizona professional can use his good offices with the IRS to help you over come your company debts.

In the event that you never have learned of an Offer in Compromise, Tax Lien Period, Uncollectible Status and Insolvency, amongst others, you desire a Phoenix professional’s help. Waste no more time, touch base with us today to get out of business tax debt and save your company from closing.

It is time to quit the earnings officers from harassing you and for all!

What is an IRS Revenue official?

An IRS official or agent is a typical visitor to daily life or your Arizona business. Getting a differentiation between the two is vital for you to know the way to deal with each. An IRS representative has the primary role of auditing tax returns. They send notifications regarding forthcoming audits via email. You can either go to local IRS office, once you get an e-mail from IRS agent or an agent comes over to your house or company to audit returns.

The Internal Revenue Service assigns you a revenue officer in these circumstances:

Inability to Collect Taxes

When the IRS has failed to collect taxes from you using the normal channels like notices, levies, telephone calls and emails.

Un-Filed Taxes

When you’ve got a reputation of not filling taxes.

Like payroll taxes when you neglect to pay certain type of taxes.<?p>

Large Tax Debts

A typical figure being 25,000 dollars or more. when your tax liability is significantly large

Law mandates remember IRS revenue officers to undertake measures to recover the taxes. These measures repossess property, freeze assets or wage garnishments, impound and may include issue levies. Expect these officers to appear at your residence or location of companies unexpected or without prior communication. In rare cases, the policemen might call you or send you emails summoning you to their offices. Attempt to cooperate with them to avoid further complicating your case and attempt to pay you delinquent taxes to the extend your income can adapt. The tax sum demands you to workout a plan to pay or in case your case is more complex, you’ll need the professional services of a lawyer.

What To Do if you Get {a Revenue Officer|an IRS Revenue Official

When you are unable to pay off your debt immediately, the IRS official might request some files and financial records. Such information like form 9297 which is send to you by the IRS, form 433-A which is used for people or form 433-B which is used for companies are used by the IRS to recognize your income, assets, and give a summary of your liabilities. Filling these forms ought to be done right and accurately therefore the professional services of an attorney are required. So, when you get these forms, the very first thing to do would be to call a lawyer.

Also, an attorney in Phoenix will review your financial situation and work out the best paying plan with the IRS revenue officers. Without an attorney, you might be intimidated by the IRS policemen into consenting to a plan that you cannot afford but which makes their job easier. In the event you are given tight datelines, an attorney get you a more flexible one and can certainly negotiate. Remember, there are lots of options that may be offered by the officer. A standard one in case associated with payroll overdue is to evaluate and assign you a retrieval fee trust fund. For this to happen, an interview must be run to determine who is the real perpetrator between a business along with a person and having an attorney in this interview in Arizona is a matter of necessity.

An Offer in Compromise agreement could save you up to 90% on your back tax debts owed

What is it

The Internal Revenue Service and/or state of Arizona helps the client faced with serious tax issues by paying or instead bailing them out up to less compared to the amount owed. Nonetheless, not all taxpayers that are distressed qualify for IRS Offer in Compromise Agreement. This is completely because qualification is based on several variables after assessment of the customer was carried out. The IRS Offer in Compromise Arrangement plays an instrumental role in helping taxpayers with distressed fiscal challenges solve their tax problems. This implies that the IRS acts as the intermediary which helps their tax debt is paid by the citizen in the most convenient and adaptable mode.

How Hard is it to Qualify?

Filling the applications doesn’t ensure the Phoenix citizen a qualification that is direct. The IRS begins the complete appraisal and evaluation procedure that may render you incapable of paying your taxes. The applications must be filled with extreme correctness saying certainly reasons for your inability to pay tax. These applications are then supported with other relevant documents that will be utilized by the Internal Revenue Service to ascertain the eligibility of the taxpayer for an Offer in Compromise Deal. Nevertheless, there are some of the few qualifications procedure that has to be met completely be the taxpayer. Many of these qualifications include but not limited to ensuring the taxpayer files all the tax returns that they are legally bound to file, make and present all the estimated amount of tax payments for the current year and eventually the taxpayer is designed to make deposits for all of the national tax for the current quarter particularly for citizens who run businesses with employees. All these are the three basic tenets of qualification that every citizen seeking help from IRS must meet to be able to be considered.

What to do now

This is an amazing law firm that can serve as a yard stick for those who demand help that is appropriate in negotiating for an IRS offer in compromise arrangement. Don’t hesitate to contact them because they have a powerful portfolio and a good safety reputation. They’ve a team of dynamic and capable professionals that are constantly on hand to help you. Try them now and experience help like never before. It’s simply the finest when it comes to discussion of an IRS offer in compromise deal.

Other Cities Around Phoenix We Serve

| Address | Phoenix Instant Tax Attorney2020 N Central Ave, Phoenix, AZ 85004 |

|---|---|

| Phone | (702) 919-6003 |

| Customer Rating | |

| Services / Problems Solved | Removing Wage GarnishmentsGetting Rid of Tax LiensRemoving Bank LeviesFiling Back Tax ReturnsStopping IRS LettersStopping Revenue OfficersSolving IRS Back Tax ProblemsIroning out Payroll Tax IssuesRelief from Past Tax IssuesNegotiating Offer in Compromise AgreementsNegotiating Innocent Spouse Relief ArrangementsPenalty Abatement NegotiationsAssessing Currently Not Collectible ClaimsReal Estate PlanningLegal Advice |

| Tax Lawyers on Staff | Steve Sherer, JD Kelly Gibson, JD Joseph Gibson, JD Lance Brown, JD |

| Cities Around Phoenix We Serve | Apache Junction, Arlington, Avondale, Bapchule, Black Canyon City, Buckeye, Carefree, Casa Grande, Cashion, Cave Creek, Chandler, Chandler Heights, Coolidge, El Mirage, Florence, Fort Mcdowell, Fountain Hills, Gilbert, Glendale, Goodyear, Higley, Laveen, Litchfield Park, Luke Afb, Maricopa, Mesa, Morristown, New River, Palo Verde, Paradise Valley, Peoria, Phoenix, Queen Creek, Rio Verde, Sacaton, Scottsdale, Stanfield, Sun City, Sun City West, Surprise, Tempe, Tolleson, Tortilla Flat, Valley Farms, Waddell, Wittmann, Youngtown |